Invest

-

In the past 15 years, passive indexing (accessible participation) and multi-managers (uncorrelated returns) have generated superior results and taken market share against traditional public equity investment managers.

However, there remains an opportunity to compound excess returns both beyond the index and with a duration edge over multi-managers.

Additionally, our team is uniquely incentivized to earn excess returns. We invest alongside our clients and only charge management costs when we generate excess returns compared to the S&P 500 (VOO).

-

Our bottoms-up selection and research progress invests in companies with sustainable competitive advantages and durable growth at a discount to generate idiosyncratic excess returns.

In aggregate, we harvest the PEG (value), ROE (quality), and dividend (income) spread against our benchmark (S&P 500: VOO) to generate systematic excess returns.

-

We believe investors needs mechanisms to isolate luck and skill. We aim to accomplish this by being intentional with our risk exposure and honest with our benchmarking.

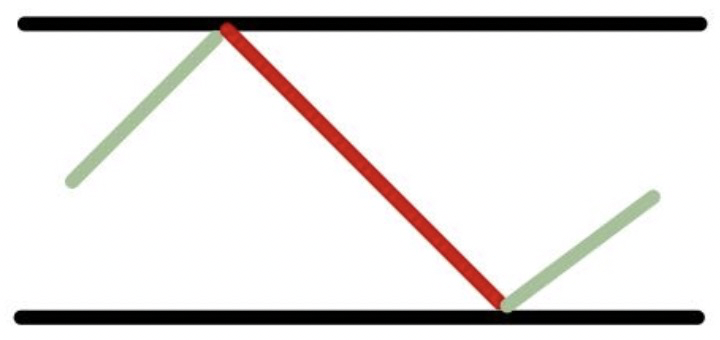

We are concentrated (5 - 25 positions), long-only, sector-neutral (within 200bps), active (75%+), and beta-controlled (0.8 - 1.2).

We measure our results against the S&P 500 (VOO) as a benchmark as well as Momentum (VFMO), Quality (VFQY), and Value (VFVA).

Our excess returns can be attributable to our bottoms-up research and conviction.