Insights

-

I took notes on eight Howard Marks memos (oaktreecapital.com/insights/memos) most relevant to public equity investors in the past three years since Sea Change (2022).

My three key takeaways are:

The key to generating excess returns lies in understanding investor sentiment. Real world developments deviate between decent and not great but investor sentiment swings between extreme highs and lows. Risk-adjusted asymmetry is alpha, and behavioral advantages are a key source.

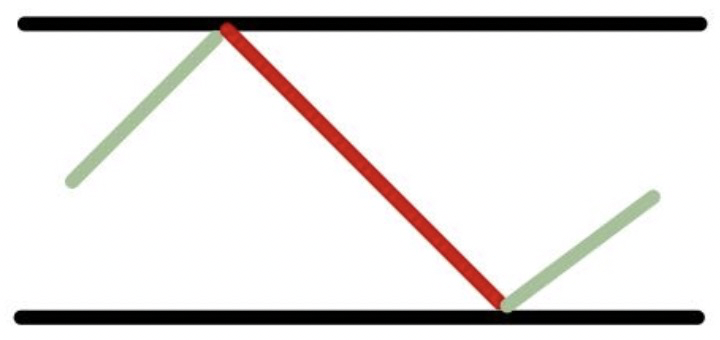

Risk control is not everything; it is the only thing. During a 14-year period, public equity returns at the General Mills pension never exceeded the 27th or 47th percentile within a single year but those second quartile annual results translated to the 4th percentile overall. Consistency is key.

Investors need mechanisms to isolate skill and luck. The zero-interest-rate-policy (ZIRP) era was a moving walkway and the return to neutral interest rates (2% - 4%) encourages better capital allocation that will test investors.

—

I also prompted ChatGPT to do the same exercise and had limited results. This exercise included 82 content pages and took me around three hours to complete.

—

Sea Change (2022) & Further Thoughts on Sea Change (2023)

Ongoing change in the investing environment (3rd change in 53 years)

Marks considers this the third sea change he has experienced in 53 years. Started with investors adopting a risk/reward mindset during the mid 70s. Then came a nearly 4-decade period with declining interest rates starting in the early 90s. The S&P 500 returned 16% annually during the 11-year period between the March 2009 bottom to the February 2020 high. This current third sea change (returning to neutral real interest rates) re-rated equity valuation multiple lower as investors demanded more earnings yield that measured up to higher rates.

While real world events and development deviate between decent and not great, investor sentiment swings between extreme highs and lows. Similarly, investors react immediately to sudden changes and are more oblivious to gradual, long-term secular trends. Only the remaining veteran investors who started in the 1960s will have experience operating in a neutral real interest rate environment.

In a return to consistent neutral real interest rates, the same investment strategies that worked over the 2009 - 2020 period may not be the same strategies that generate excess returns in the decades ahead. Probable consequences include slower economic growth and margin compression. Declining interest rates in an environment is similar to walking on a moving walkway where you travel both the distance you were walking as well as the distance the walkway carried you. Investors who enjoyed success likely need to reexamine their strategies and separate their own skills and a rising tide. Quote: In the new environment, earning exceptional returns will likely once again require skill in making bargain purchases and, in control strategies, adding value to the assets owned.

Taking the Temperature (2023)

Making market calls (5 calls over 5 decades)

Bubbles are irrationally elevated opinions on an asset or sector and the early 2000s TMT bubble is an example where investors paid up on revenue multiples with no clear path to earnings generation or sometimes even pre-revenue ideas.

Investors can mistake that higher risk must be correlated with higher returns. Alternatively, being contrarian and acting when markets are incredibly misbalanced in sentiment or valuation has a better risk/reward skew. In rare occasions, things cannot get more extreme, and investor expectations can be caught unbalanced. Oaktree invested $6B in a single quarter back in the 2008 bottom. Oaktree does not wait to buy at the bottom since that is impossible to time and simply buys when they can access value cheap. Quote: Skepticism and pessimism are not synonymous.

In the period 2000 through 2011, the S&P 500 returned an overage +0.55% over 12 years. However, extrapolating is very dangerous and the next period 2012 - now has been explosive in public equities. Put simply: the more people have sold, the less there is to sell, and the more cash they have with which to buy when they turn less pessimistic. There are no called strikes in investing, and you can wait on an obvious opportunity during an extreme market to decide and act. In the meantime, it is very attractive to stay invested and ride in the long-term economic growth and trends. The key to generating excess returns: lies in understanding prevailing investor psychology. The contrarian needs to understand the herd, why they are wrong, and what should be done instead. Selling at the bottom is worse than buying at the top because it is permanent.

Few Losers, or More Winners? (2023)

Risk control is not everything; it is the only thing

Quote: Striving to do a little better than average every year and through discipline to have highly superior relative results in bad times is (a) less likely to produce extreme volatility (b) less likely to produce huge losses which cannot be recouped and, most importantly, (c) more likely to work. Equity returns at General Mills pension never ranked above the 27th percentile or 47th percentile but that resulted in 4th percentile overall over 14 years.

Quote: Understanding the distinction between risk control and risk avoidance is truly essential. Risk avoidance is likely to result in return avoidance. Style along never determines outcome. Concentration where winners drive results is a recurring problem is US public equity indices.

Risk-adjusted asymmetry is alpha, and a behavioral advantage is a key source.

Easy Money (2024)

Low rates alter investor behavior, distorting it in ways that have serious consequences

Low rates stimulate the economy, reduces perceived opportunity costs, raise asset prices, encourages risk taking, lead to malinvestment, enables more deals, encourages more leverage, creates winners/losers, and induces optimistic behavior that lays the groundwork to the next crisis.

Low rates encourage investors into long-duration assets like public equities and growth stocks with distant earnings. In low-return times, investments are made that should not be made; buildings are built that should not be built; and risks are borne that should not be borne. Natural interest rates (2% - 4%) lead to better capital allocation.

Cycles are a never-ending story and each event in the progression has a causal relationship with the next. Excesses and corrections are a better way to think about cycles than ups and downs. In a 2 by 2 game theory matrix, investment managers are encouraged to act with the herd and be outcome agnostic when a more productive exercise is to be idiosyncratic, contrarian, and right. Munger: easy money corrupts, and really easy money corrupts absolutely.

Mr. Market Miscalculates (2024)

Aggregate psychology dislocates markets

During crisis, all asset class correlations go to 1. This can primarily be attributed to investor psychology swinging towards excessive pessimism.

Markets are not built on natural laws but rather investor psychology. Graham: The market is a voting machine in the short-term and a weighing machine in the long-term.

Emotion? No. Analysis? Yes.

On Bubble Watch (2025)

History rhymes

Market concentration and US exceptionalism themes are at an all-time high relative to recent memory but is it a bubble? Bubbles are highly irrational exuberance resulting in conviction that there is no price too high.

Bull market stages (a) investors are licking their wounds, and highly dispirited (b) improvement takes place, and most investors accept this (c) everyone concludes that things can only get better. Psychological extremeness marks a bubble.

When something is new or has no history, there is no context to temper enthusiasm. Quote: There is no asset so good it cannot become overpriced and thus dangerous. In the real world, trees do not grow to the sky. Investors can adopt a lottery ticket mentality where expected value attractiveness overrides real analytical probabilistic thinking. Change seems to be more the rule than persistence. The riskiest thing is to believe there is no risk.

-

An 18-year-old in Cleveland back in 2003 was worth $71M or an implied 32x LTM P/E. What does LeBron James have in common with growth-at-a-reasonable-price (GARP)?

In this exercise, we travel back in time to 2003 and apply a modern value investing approach with hindsight to evaluating then 18-year-old LeBron James and his market-beating earnings power as a rookie in the NBA.

LeBron James (born 1984) is a 4x NBA Champion, 4x NBA MVP, the NBA all-time leading scorer, and 3x Olympic Gold Medalist. Over his two decade career, he has accumulated $529M (pretax) in team contract earnings (including Cleveland Cavaliers, Miami Heat, and Los Angeles Lakers). His agent is Rich Paul who runs KLUTCH Sports and his business partner is Maverick Carter who runs LMLR Ventures. In this exercise, we ignore his endorsement and investment earnings due to their limited disclosure.

In an NPV analysis, we calculated the correlation between LeBron earnings and the S&P 500 over 21 years as beta (0.84) to apply the capital-asset-pricing-model (CAPM) with 4% Damodaran equity-risk-premium (ERP) and arrived at an 11% discount rate. This allowed us to discount back the $275M in post-tax earnings to 2003 which is equivalent to $71M or 32x LTM P/E (a 10x turn premium to the S&P 500!). This large premium to the S&P 500 is proven correct with hindsight. LeBron grew his annual contract by 13% CAGR and his post-tax earnings by 12% CAGR over 21 years compared to 8% in S&P 500 EPS CAGR over the same period. With hindsight, LeBron has been a steady compounder over 21-years with contractual revenue, high margins, and very little capital intensity. Looking through the price-to-earnings-growth (PEG) lens, the 32x LeBron multiple translates to 2.5x PEG or a discount to the S&P 500 at 2.9x PEG.

This is all without considering terminal value which LeBron has secured with a billion-dollar Nike endorsement and many other endorsement/investments. Despite being the consensus number one overall pick in 2003 and deemed The Chosen One, analysts still underestimated LeBron James. His basketball-IQ, maintenance, and investment acumen has driven his historic longevity and durability.

To conclude, value is the ultimate north star and valuation approaches to investments with durable growth horizons should be adjusted to include growth and intangibles. -

Investors are too pessimistic on Google Search

Recently, Coatue (TMT Tiger Cub, $70B AUM) implied that Alphabet (GOOG) would lose -90% its market cap by 2030E in their 2025 East Meets West Keynote. In our perspective, investor expectations implied in the current GOOG valuation are too pessimistic.

In a SoTP analysis using the current GOOG valuation, we backed into an implied 2x NTM EV/Sales on Google Search which is a -80% discount to Meta (META). Putting the SoTP back together using the META 9x NTM EV/Sales multiple on Google Search suggests $3.4T in EV or 70% upside to GOOG today.

While the competitive threats are real, we believe investor expectations implied in the current GOOG valuation are too low.

---

Key assumptions

Search multiple (META NTM EV/Sales), 9x or 54% EV (56% total revenues today)

HSD growth, 35% - 40% EBIT margins, closest comp META

YouTube multiple (AVERAGE(NFLX, SPOT) EV/Sales), 9x or 9% EV (10% total revenues today)

LDD growth, 35% - 40% EBIT margins, closest comp NFLX & SPOT

Network multiple (AVERAGE(TTD, APP) NTM EV/Sales), 15x or 12% EV (9% total revenues today)

~15% growth, 15% - 20% EBIT margins, closest comp TTD, APP

Subscription & Devices multiple (AAPL NTM EV/Sales), 7x or 9% EV (total 13% revenues today)

LDD growth, 30% - 35% EBIT margins, closest comp AAPL

Cloud multiple (AVERAGE(MSFT, ORCL, MDB, SNOW, DDOG NTM EV/EBIT), 61x or 16% EV (15% total revenues today)

HDD growth, 20% - 25% EBIT margins, closest comp AWS, MSFT Azure, ORCL, MDB, SNOW, DDOG

Other Bets multiple (AVERAGE(MBLY, UBER, TSLA) NTM EV/Sales), 6x or 0% EV

growth unclear, margins unclear, closest comp MBLY, UBER, TSLA

-

Returning to same-store-sales growth and normalized margins presents a midteens IRR opportunity over 2 - 3 years

Business Primer

Dollar General (DG) is the largest retailer in the US by store count, with more than 20,000 locations across the country. It primarily sells individual daily necessities and staples (~82% consumables) typically to low-income shoppers in rural America. Locations tilt towards rural communities underserved by big box retailers like Walmart (WMT) or Costco (COST). Superior network density and convenience in rural markets too small to sustain a second competitor has given DG a sustainable competitive advantage.

The Set-Up

Management built up excessive discretionary inventory post pandemic anticipating continued supply chain shocks and stimulus spending. DG same-store-sales and operating margins have deteriorated since the pandemic as a result, leading to CEO Todd Vasos (2015 – 2022) returning to his old post. In its 15-year public trading history, DG valuation multiples have been range bound with FY2 P/E between 12x and 22x. DG currently trades 13x FY2 P/E, 1 turn above its record low (12x) and 3 turns below median (16x).

Thesis

Renewed management to lead proven business model towards long-term recovery

Dollar General (DG) is returning to same-store-sales growth and pre-pandemic margins under a renewed management team while historical low valuations give us the chance participate in its long-term recovery. DG delivers higher margins than big box competitors given its higher price per unit. Average tickets at DG are generally $15 - $20 dollars, protecting DG against ecommerce and delivery threats. Compared to competitor Dollar Tree (DLTR) with discretionary exposure supplied overseas, DG has limited exposure to cross border goods implicated in the ongoing trade war. Anticipating a robust return to same-store-sales growth between store remodels, new location geographic whitespace, and consumer trade down compounded with normalized margins, we believe the current valuation is very attractive.

-

Compounding midteens sales growth and high incremental margins with a capital light business model

Business Primer

Uber (UBER) is the global leader in rideshare and delivery demand aggregation with 150M+ global monthly active users. Both the Mobility and Delivery segments earn a take rate (~25%) on each order placed. Uber is the clear leader in ride-hailing (~80% market share) and the secondary player in Delivery (~20% market share) with Uber Eats trailing DoorDash (DASH). Both markets have clear growth runways with autonomous vehicles dominating headlines and contributing the bull/bear case.

The Set-Up

UBER recently made the transition to consistent cash generation but there is high uncertainty and key debates around the evolving competitive landscape with autonomous vehicles and regulatory challenges in various markets. On a two-year lookback, UBER (3.0x FY2 EV/Sales) is trading at a discount to valuation multiple highs reached in October 2024 (3.7x FY2 EV/Sales).

Thesis

Sustainable market position and high incremental margins to compound attractive IRR

Critics say that autonomous vehicles at scale with superior cost structures will render the UBER take-rate model uncompetitive and pressure long-term growth and margins. This terminal value threat can be mitigated by the capital light model UBER employs and evolving competitive dynamics. Capital intensive autonomous vehicles at scale require a delicate and challenging balance between network reliability and utilization. Alternatively, UBER has reached critical mass with ~80% market share in Mobility and presents a strong value proposition to potential AV (Waymo, Tesla, etc.) partners trying to enhance utilization while maintaining network reliability.

Waymo is the current leader in autonomous rides operating an ~8M annual rides run rate. This is compared to the 9B+ rides UBER provides annually. Should the technology or consumer adoption progress slowly and not make material unexpected impact to UBER over the next 5 years, investors can enjoy 20%+ IRR through EPS growth and a multiple trending towards normality.